The Only Guide for Palau Chamber Of Commerce

Wiki Article

The Basic Principles Of Palau Chamber Of Commerce

Table of ContentsNot known Factual Statements About Palau Chamber Of Commerce Palau Chamber Of Commerce Can Be Fun For AnyoneAn Unbiased View of Palau Chamber Of CommerceThe Basic Principles Of Palau Chamber Of Commerce The 9-Minute Rule for Palau Chamber Of CommerceThe Best Strategy To Use For Palau Chamber Of CommercePalau Chamber Of Commerce Fundamentals ExplainedNot known Facts About Palau Chamber Of Commerce

As a result, not-for-profit crowdfunding is getting hold of the eyeballs these days. It can be made use of for details programs within the company or a general donation to the cause.During this step, you might desire to assume regarding milestones that will certainly indicate a possibility to scale your not-for-profit. Once you have actually operated for a little bit, it's important to take some time to believe about concrete development objectives.

The Definitive Guide for Palau Chamber Of Commerce

Resources on Beginning a Nonprofit in various states in the US: Beginning a Not-for-profit Frequently Asked Questions 1. How much does it set you back to start a nonprofit company?

The 8-Second Trick For Palau Chamber Of Commerce

With the 1023-EZ type, the processing time is generally 2-3 weeks. Can you be an LLC as well as a nonprofit? LLC can exist as a nonprofit limited obligation company, nevertheless, it must be entirely had by a single tax-exempt not-for-profit company.What is the difference between a foundation and a nonprofit? Structures are usually moneyed by a family members or a corporate entity, but nonprofits are funded through their incomes as well as fundraising. Structures normally take the cash they began with, invest it, and also after that disperse the cash made from those financial investments.

Some Known Details About Palau Chamber Of Commerce

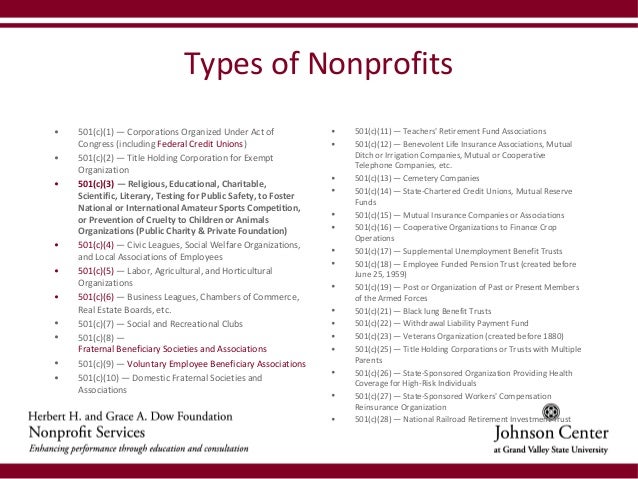

Whereas, the added money a nonprofit makes are made use of as operating costs to fund the company's goal. Nonetheless, this isn't always real when it comes to a foundation - Palau Chamber of Commerce. 6. Is it hard to start a not-for-profit organization? A nonprofit is an organization, yet starting it can be quite extreme, needing time, quality, and also cash.Although there are a number of actions to begin a not-for-profit, the obstacles to entry are reasonably couple of. 7. Do nonprofits pay taxes? Nonprofits are excluded from federal earnings tax obligations under section 501(C) of the internal revenue service. However, there are specific conditions where they may require to pay. If your not-for-profit makes any earnings from unassociated activities, it will certainly owe earnings tax obligations on that quantity.

The Ultimate Guide To Palau Chamber Of Commerce

By much the most common kind of nonprofits are Area 501(c)( 3) companies; (Area 501(c)( 3) is the component of the tax code that licenses such nonprofits). These are nonprofits whose goal is philanthropic, religious, academic, or scientific.

6 Easy Facts About Palau Chamber Of Commerce Shown

The lower line is that look at this web-site exclusive foundations get a lot even worse tax obligation therapy than public charities. The primary difference in between exclusive structures as well as public charities is where they get their financial backing. A private structure is typically managed by a private, family, or corporation, and obtains many of its revenue from a few contributors as well as investments-- an example is the Bill and also Melinda Gates Structure.

Excitement About Palau Chamber Of Commerce

This is why the tax obligation law is so challenging on them. A lot of foundations just give cash to various other nonprofits. Somecalled "running structures"run their own programs. As a practical matter, you require a minimum of $1 million recommended you read to start an exclusive structure; otherwise, it's unworthy the trouble as well as expenditure. It's not surprising, then, that an exclusive structure has been explained as a huge body of money surrounded by individuals that want some of it.Various other nonprofits are not so fortunate. The internal revenue service at first assumes that they are exclusive foundations. A brand-new 501(c)( 3) company will certainly be identified as a public charity (not a personal foundation) when it uses for tax-exempt status if it can reveal that it fairly can be expected to be openly supported.

The Basic Principles Of Palau Chamber Of Commerce

If the IRS categorizes the nonprofit as a public charity, it maintains this standing for its very first five years, no matter of the general public assistance it actually receives during this time around. Palau here are the findings Chamber of Commerce. Beginning with the nonprofit's 6th tax obligation year, it has to show that it meets the general public support examination, which is based upon the support it receives throughout the present year and previous four years.If a nonprofit passes the examination, the IRS will continue to check its public charity condition after the first 5 years by needing that a completed Set up A be filed every year. Palau Chamber of Commerce. Figure out more concerning your nonprofit's tax obligation standing with Nolo's book, Every Nonprofit's Tax obligation Guide.

Report this wiki page